Lee M. Shavel will be appointed our

| |

Retired Chief Executive Officer, following the 2022 Annual Meeting and has been nominated by our Board to stand for election as a director at the 2022 Annual Meeting. Mr. Shavel has been our Group President since February 2021, and our Chief Financial Officer since November 2017. In addition to his CFO role, Mr. Shavel had oversight responsibility for the operations of our energy, specialized markets and financial services segments. Prior to joining Verisk, Mr. Shavel served as Chief Financial Officer and Executive Vice President, Corporate Strategy of Nasdaq, Inc. from May 2011 to March 2016. Before joining Nasdaq, Mr. Shavel was Americas Head of Financial Institutions Investment Banking at Bank of America Merrill Lynch. Previously, he was Head of Finance, Securities and Technology and Global COO for the Financial Institutions Group at Merrill Lynch. Mr. Shavel joined Merrill Lynch in 1993 as an Associate, coming from Citicorp where he worked as an Associate in the Financial Institutions Group. Since June 2020, Mr. Shavel has served on the Board of Directors of FactSet Research Systems, Inc. (NYSE: FDS), a publicly traded company, and from 2016 to March 2019, Mr. Shavel served as a board director and chair of the Audit Committee of Investment Technology Group, Inc., a publicly traded broker-dealer. In assessing Mr. Shavel’s skills and qualifications to serve on our Board, our directors considered his in-depth operations, management and financial experience and knowledge gained from the various executive positions held by Mr. Shavel within Verisk since 2017, as well as his current and past service as a director on other public company boards. Our Board unanimously recommends a vote “FOR” the election of all five (5) nominees. Proxies solicited by our

Board will be voted “FOR” these nominees unless otherwise instructed.

6 | Verisk 2022 Proxy Statement

Item 1

Continuing Directors

Directors with terms continuing until 2023

| | | | | | | | |  | | Christopher M. Foskett

Independent Lead Director

Age 64

Committees: Executive; Finance and Investment

| | |

Christopher M. Foskett has served as one of our directors since 1999 and as our Independent Lead Director since May 2019. Mr. Foskett currently serves as Chief Sales Officer at Fiserv, Inc. Previously, Mr. Foskett served as Executive Vice President, Head of Corporate and Business Development and Co-Head of Global Financial Solutions at First Data Corporation. Before joining First Data, he was the Managing Director, Head of North American Treasury Services and Global Head of Sales for Treasury Services at JPMorgan Chase & Co. Mr. Foskett also spent 18 years at Citigroup in a number of key executive roles, including Global Head of Mergers and Acquisitions, Head of Global Sales for Transaction Services and Global Head of the Financial Institutions Group in the Corporate Bank. Mr. Foskett currently chairs the Board of Directors for Allied Irish Bank Merchant Services and also serves on the Board of Directors for Finxact and Apiture. In assessing Mr. Foskett’s skills and qualifications to serve on our Board, our directors considered his more than 30 years in the banking and financial services industries, and experience gained as a senior executive with global financial institutions.

| | | | | | | | |  | | David B. Wright

Independent Director

Age 73

Committees: Audit; Compensation

| | |

David B. Wright has served as one of our directors since 1999. Since August 2014, Mr. Wright has served as Managing Partner of Innovative Capital Ventures, Inc. and since November 2020 has served as Executive Chairman of Twist Capital. From July 2012 to May 2014, Mr. Wright served as the Chief Executive Officer of ClearEdge Power, a privately held company. From February 2010 to July 2011, Mr. Wright served as the Executive Vice Chairman and Chief Executive Officer of GridIron Systems. Mr. Wright served as Chief Executive Officer and Chairman of Verari Systems, Inc., from June 2006 to December 2009. He was Executive Vice President, Office of the CEO, Strategic Alliances and Global Accounts of EMC Corporation from July 2004 until August 2006. From October 2000 to July 2004, Mr. Wright served as President, Chief Executive Officer and Chairman of the Board of Legato Systems. Prior to joining Legato Systems, Mr. Wright had a 13-year career with Amdahl Corporation, where he served as President and Chief Executive Officer from 1997 to 2000. Mr. Wright also previously served on the Board of Directors of ClearEdge Power, GridIron Systems, ActivIdentity Corp., Aspect Communications Corp., Boole and Babbage Inc. and GeekNet, Inc. In assessing Mr. Wright’s skills and qualifications to serve on our Board, our directors considered the operations and management experience he gained in leadership positions in diverse businesses.

| | | | | | | | |  | | Annell R. Bay

Independent Director

Age 66

Committees: Compensation (Chair); Executive; Governance, Corporate Sustainability and Nominating

| | |

Annell R. Bay has served as one of our directors since August 2016. Ms. Bay has more than 35 years of experience in the oil and gas industries. Ms. Bay most recently served as vice president of global exploration for Marathon Oil Corporation, from June 2008 until her retirement in April 2014. Ms. Bay was previously Vice President of Americas exploration for Shell Exploration and Production Company and Vice President of worldwide exploration at Kerr McGee Oil and Gas Corporation. Earlier in her career, Ms. Bay held positions in operations and applied research at Chevron, Sohio, and Oryx Energy. Ms. Bay serves on the advisory boards for the Jackson School of Geology at the University of Texas at Austin, the Houston Education Center for the Independent Petroleum Association of America and is a Trustee of Trinity University in San Antonio, Texas. Ms. Bay has served on the Board of Directors of the Apache Corporation, a publicly traded energy company, since 2014, and Hunting PLC, a UK-listed energy services company, since 2015. In assessing Ms. Bay’s skills and qualifications to serve on our Board, our directors considered her deep knowledge of the oil and gas industries and her extensive global experience in the exploration of conventional and unconventional oil and gas reservoirs and in exploration portfolio risk management.

| | | | | | | | |  | | Vincent K. Brooks

Independent Director

Age 63

Committees: Governance, Corporate Sustainability and Nominating; Audit

| | |

Vincent K. Brooks has served as one of our directors since October 2020. A career Army officer who served in the U.S. Army for over 42 years, retiring from active duty in 2019 as a four-star general, General Brooks spent his final seventeen years as a general officer and in nearly all of those years in command of large, complex military organizations in challenging situations. During his tenure in the Army, he gained uncommon experience in leading through complex, ambiguous situations with significant national security interests and risks at stake. He handled crisis management, public communications, risk management and mitigation, budgetary assessment, leadership and management, international relations and interactions, cyber defense and protection, congressional engagement and strategic planning. General Brooks has served on the board of two public companies, Diamondback Energy since April 2020 and Jacobs since August 2020, as well as the board of the Gary Sinise Foundation since March 2019 and the board of the Korea Defense Veterans Association since February 2020. General Brooks is also a principal with WestExec Consulting, a visiting Senior Fellow at Harvard Kennedy School’s Belfer Center for Science and International Affairs, and a Distinguished Fellow at the University of Texas with both the Clements Center for National Security and the Strauss Center for International Security and Law. In assessing General Brooks’ skills and qualifications to serve on our Board, our directors considered General Brooks’ strong leadership skills, together with his deep knowledge of policy, strategy and geopolitical matters.

Verisk 2022 Proxy Statement | 7

Item 1

Directors with terms continuing until 2024

| | | | | | | | |  | | Samuel G. Liss

Independent Director

Age 65

Committees: Finance and Investment (Chair); Audit; Executive

| | |

Samuel G. Lisshas served as one of our directors since 2005. Mr. Liss is the principal of WhiteGate Partners LLC, a financial services advisory firm, and an Adjunct Professor at both Columbia University Law School and New York University Stern Graduate School of Business. Previously, Mr. Liss served as Executive Vice President and Group Business Head at The Travelers Companies, overseeing corporate business development and one of three operating divisions —Financial, Professional Lines and International Insurance. Earlier in his career, Mr. Liss was a Managing Director in the Investment Banking and the Equities divisions at Credit Suisse, working with financial and business services companies. Mr. Liss began his career in the equities division at Salomon Brothers. Mr. Liss has served on the Board of Directors of Argo Group International Holdings, Ltd., a publicly-traded company, since February 2019. Mr. Liss formerly served on the Boards of DST Systems, Inc., Ironshore, Inc. and Nuveen Investments Inc. In assessing Mr. Liss’ skills and qualifications to serve on our Board, our directors considered his management and operational experience gained as a senior executive of a global insurance business, his expertise in investment banking and the capital markets, and his Board governance experience.

| | | | | | | | |  | | Bruce Hansen

Independent Director

Age 62

Committees: Audit (Chair); Compensation; Executive

| | |

Bruce Hansen has served as one of our directors since May 2015. From 2002 to 2012, Mr. Hansen served as Chairman and CEO of ID Analytics, a company he co-founded in 2002. Prior to that, Mr. Hansen served as President of HNC Software, Inc., a publicly traded company. Mr. Hansen has also held executive roles at CASA Inc., CitiGroup, ADP and JPMorgan Chase. Mr. Hansen currently serves on the Board of Directors of MITEK Systems Inc., a publicly traded company, as well as RevSpring, Inc. and GDS Link, LLC, each a privately held company. Mr. Hansen is also an active member of the National Association of Corporate Directors. In assessing Mr. Hansen’s skills and qualifications to serve on our Board, our directors considered his management and operations experience gained as a senior executive of multiple data analytics businesses, as well as his experience gained by his current and past service on other public company boards.Insurance Commissioners

| | | | | | | | |  | | Therese M. Vaughan

Independent Director

Age 65

Committees: Governance, Corporate Sustainability and Nominating (Chair); Compensation; Executive

| | |

Independent Director Age: 67 Director since: 2013 Committees: • Governance, Corporate Sustainability and Nominating (Chair) • Audit • Executive | |

| |

| | Therese M. Vaughan has served as one of our directors since February 2013. Dr. |

| Career Highlights Therese M. Vaughan is currentlywas the Professional Director of the Emmett J. Vaughan Institute of Risk Management and Insurance at the University of Iowa.Iowa from 2021 to 2023. Dr. Vaughan previously served as Executive-in-Residence, Distinguished Professor, Interim Dean and Dean of the College of Business and Public Administration at Drake University. Dr. Vaughan is a leading expert in insurance regulation having served as Chief Executive Officer of the National Association of Insurance Commissioners from February 2009 to November 2012 and as Commissioner of the Iowa Insurance Division, directing all insurance business transacted in the State of Iowa, from August 1994 to December 2004. Current Other Public Company Directorships West Bancorporation (NASDAQ: WTBA), Hamilton Insurance Group, Ltd. (NYSE: HG) Prior Other Public Company Directorships American International Group (NYSE: AIG); Validus Holdings, Ltd. (NASDAQ: VR), Principal Financial Group, Inc. (NASDAQ: PFG), Endurance Specialty Holding Ltd. (NYSE: ENH) Other Professional Experience and Community Involvement Dr. Vaughan has served on the Boards of Directors of Wellmark Blue Cross and Blue Shield since 2013. She is an Associate of the Society of Actuaries (ASA), a Chartered Property Casualty Underwriter (CPCU), and an Associate of the Casualty Actuarial Society (ACAS). Dr. Vaughan has served on the Boards of Directors of Wellmark Blue Cross and Blue Shield since May 2013, West Bancorporation since April 2019 and American International Group since May 2019. Dr. Vaughan has previously served on the Board of Directors of Validus Holdings, Ltd., Principal Financial Group, Inc. and Endurance Specialty Holding Ltd. Qualifications In assessing Dr. Vaughan’s skills and qualifications to serve on our Board, our directors considered her deep knowledge of the insurance industry, its market dynamics and trends, and its regulatory environment gained from her experience with the National Association of Insurance Commissioners and as Commissioner of the Iowa Insurance Division. | | | | | | | | |  | | Kathleen A. Hogenson

|

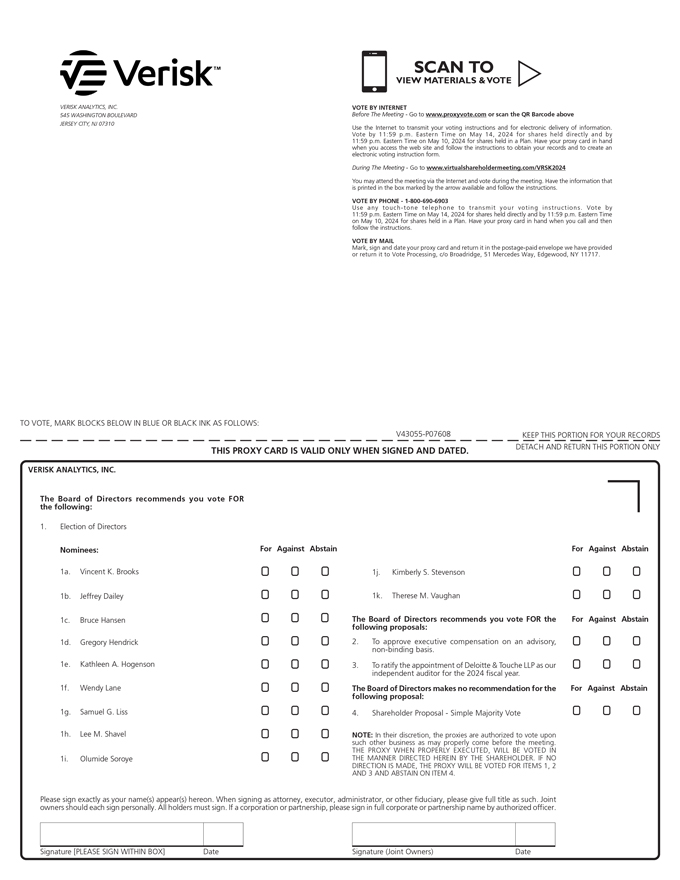

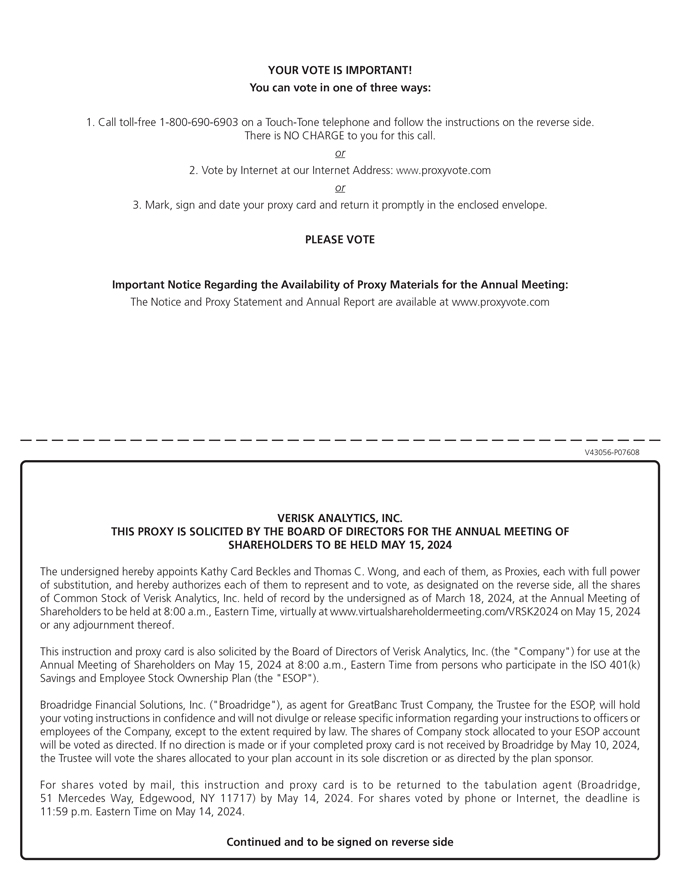

Our Board unanimously recommends a vote “FOR” the election of all eleven (11) nominees. Proxies solicited by our Board will be voted “FOR” these nominees unless otherwise instructed. 12 | Verisk 2024 Proxy Statement

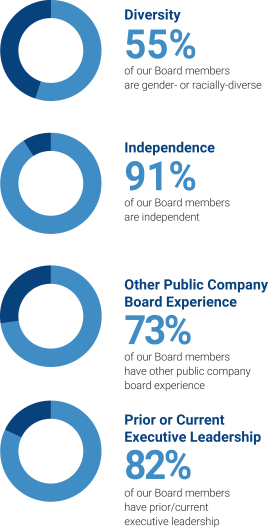

Corporate Governance Corporate Governance Strengths We are committed to good corporate governance, which promotes the long-term interests of our shareholders and strengthens our Board and management accountability. Highlights of our corporate governance practices include the following: Corporate Governance Highlights Independent Director

Age 61

Committees: Finance and Investment; Governance, Corporate Sustainability, and Nominating

| | |